A call center experience that supports the way agents want to worK.

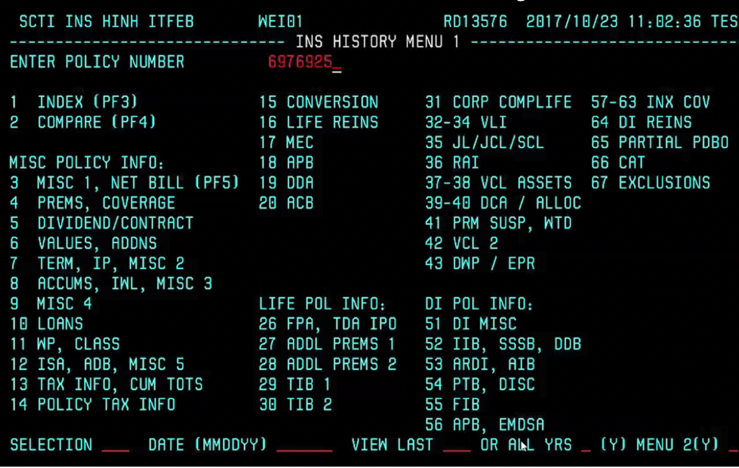

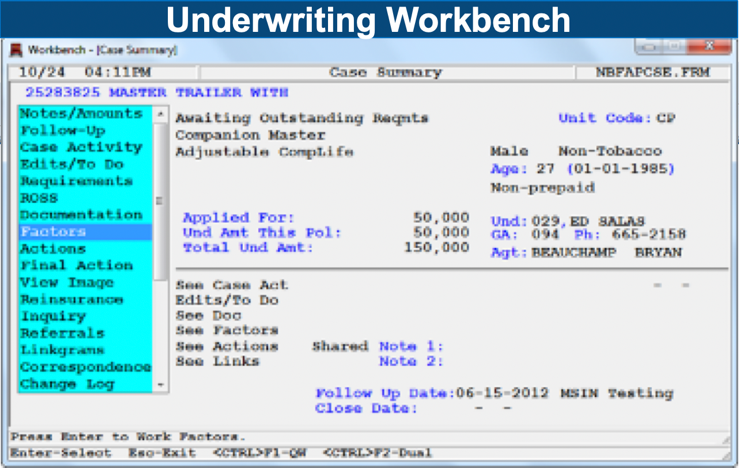

I co-led the earliest explorations into redesigning Northwestern Mutual's call center in Franklin, Wisconsin. It consisted of nearly 1,200 agents and representatives, all super-specialized in specific products or servicing tasks. Each specialization had well over a dozen custom-built tools to carry out their tasks, most of which were decades old. They each had unique workarounds. Many representatives would re-type data across their workflows. Others built and shared custom Excel macros and shared them with colleagues to overcome the software's deficiencies. On top of these wildly inefficient practices, they were being tracked for their productivity.

This resulted in frustrated clients whose phone calls would, on average, get transferred nine times before resolving their request. Approx. 70% time spent on calls is related to poor servicing tools provided to agents, and 60% of those calls did not end in a transaction. Agents use up to 20-25 separate apps/systems. Agent attrition was high, and so was on-boarding — it took up to nine months to train new employees. Tens of thousands of policyholders got lost in the fray, and the company lost millions in missed client opportunities, tech debt, and inefficient employees.

MY ROLE

Service Design, Product Design, Research, Design Strategy

THE TEAM

Alex Cheek (Co-Lead), Natalia Lavric (ADCS), Ajit Panigrahi (Senior UX)

STREAMLINING THE SERVICE CENTER

The other dimension to the servicing organization was fractured oversight: each specialization reported up through different parts of the organization. Creating a cohesive service experience first required buy-in across the organization, restructuring, and an agreement on new budgeting.

The goals set forth to the executive committee included 1) a more generalized approach to servicing, reducing the inefficient specialization that led to far too many call transfers and lengthy onboarding times, and 2) moving most of their outdated software to NM Connect where they could perform servicing alongside the field representatives.

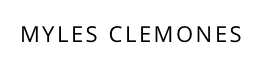

Above, a proposal to consolidate servicing representatives into four groups: representatives for “orphaned” clients, both generalized and dedicated; general representatives who can easily act on incoming requests from the field or from customers; and processing specialists who have a higher level of technical training, e.g., insurance underwriting or certified financial planners. Achieving this simplification was largely possible through our team’s single digital platform approach.

CONNECTING THE SERVICE EXPERIENCE AND DIGITAL PLATFORM WILL RESULT IN NEW WAYS TO HELP 4.5 MILLION CLIENTS AND 8,000 FIELD REPS. AFTER DESIGNING AND LAUNCHING MODERN SELF-SERVICING TOOLS, THE HOME OFFICE CUT $20MM IN ANNUAL OPERATING COSTS FOR BILL PAYMENTS ALONE.

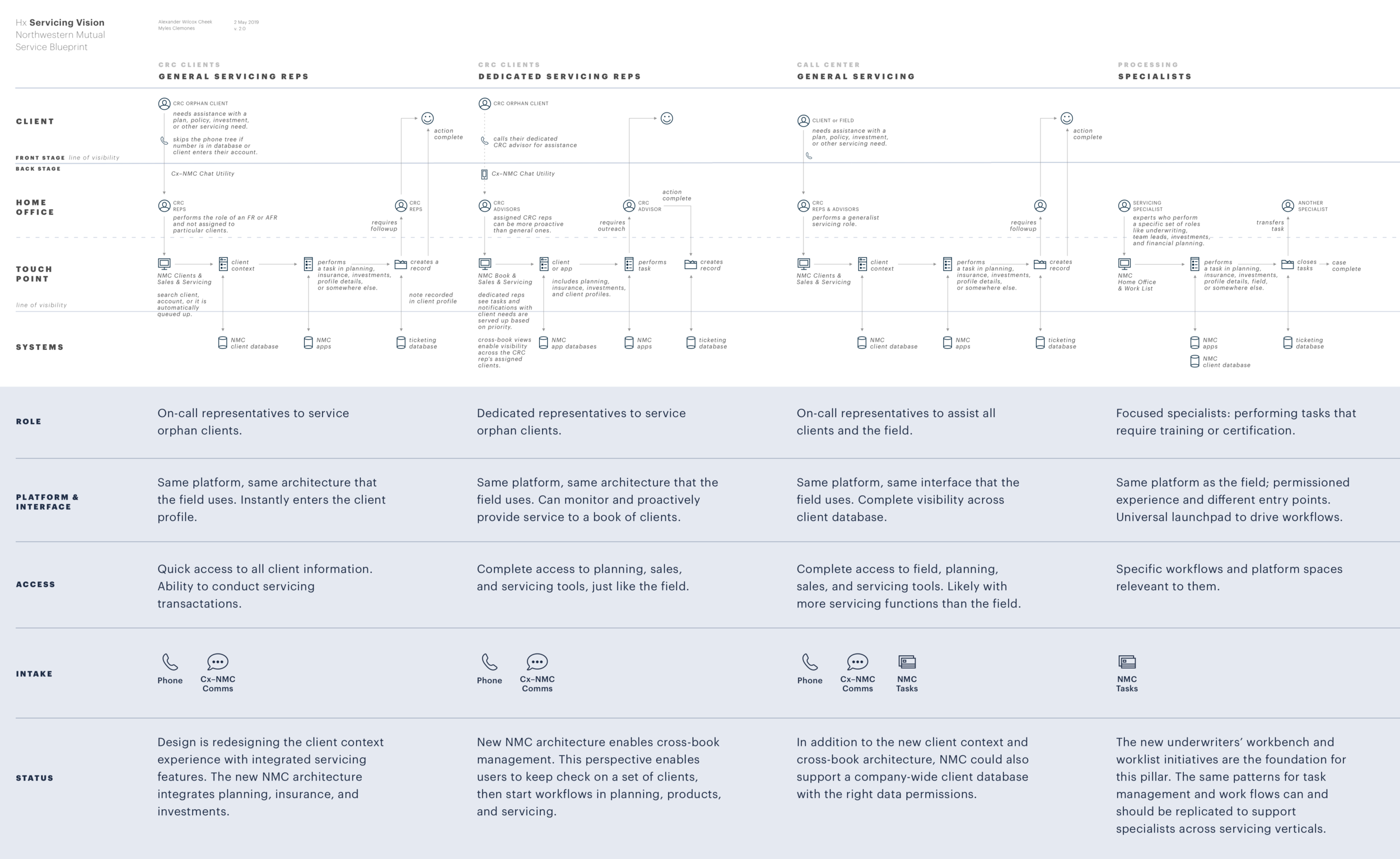

Steering a service center strategy required a considerable amount of diagramming the possibilities and presenting the future in the simplest possible terms. Many stakeholders needed a clear understanding of how a great user experience and streamlined foundation were better business strategies than buying an off-the-shelf solution. Here, we articulated that the same interface and platform for both the call center and the business users led to a better client experience, more transparency for all parties, and a better flow of information.

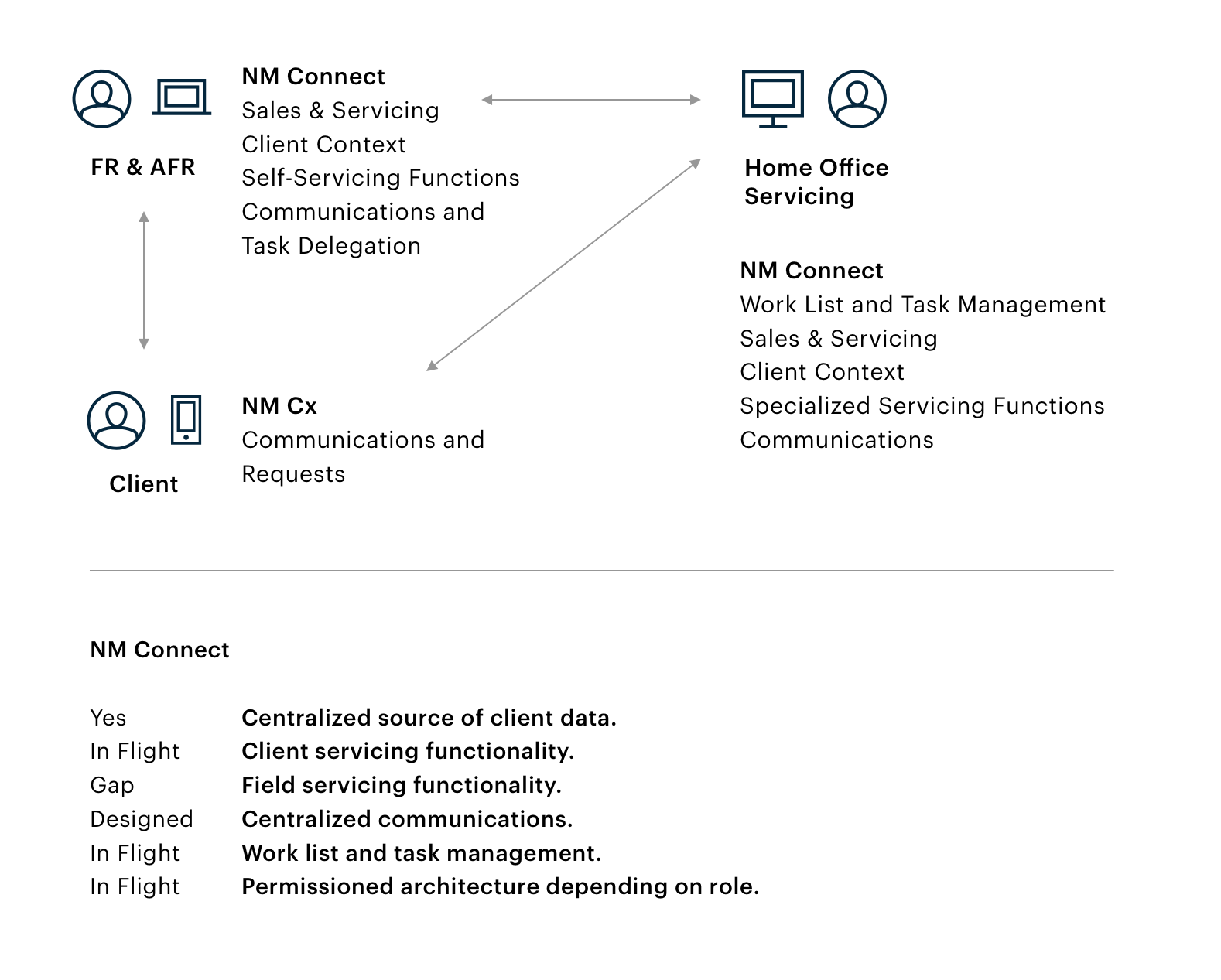

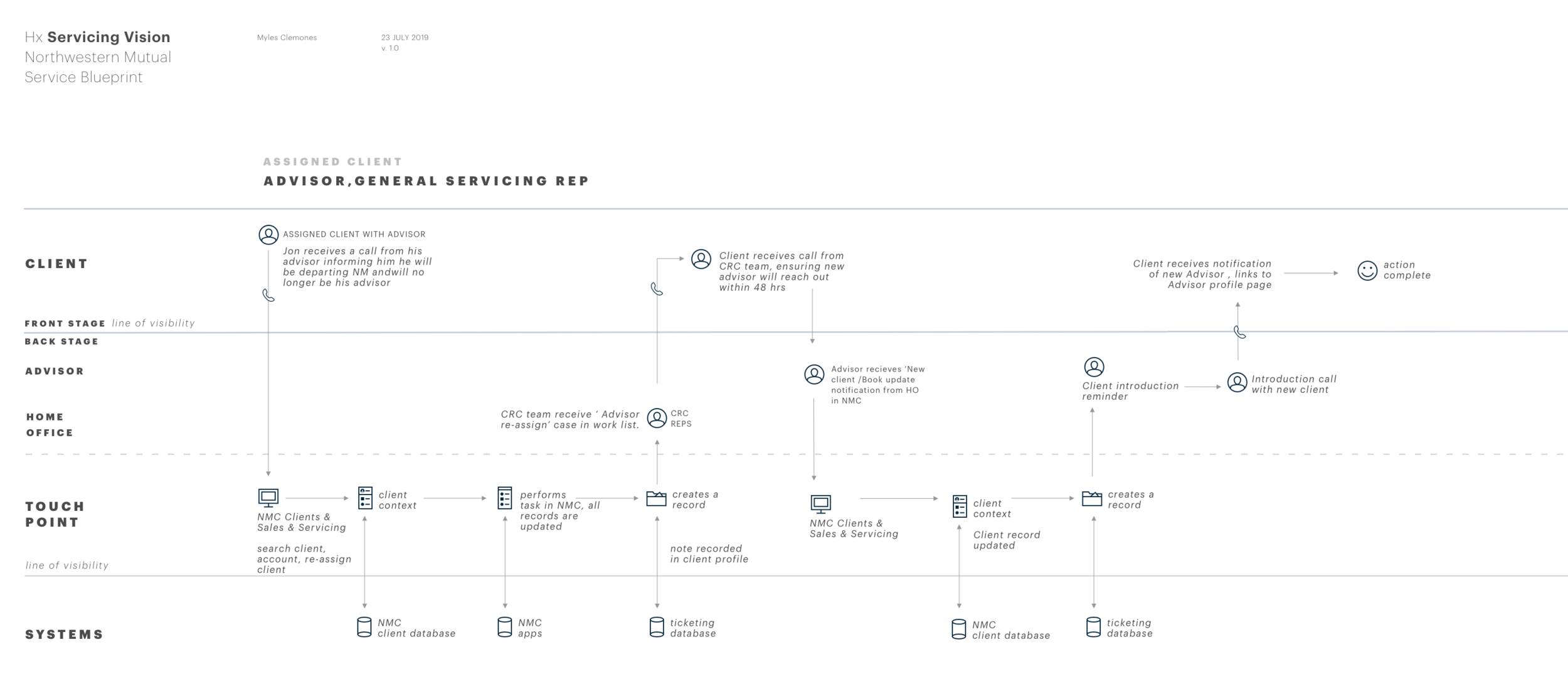

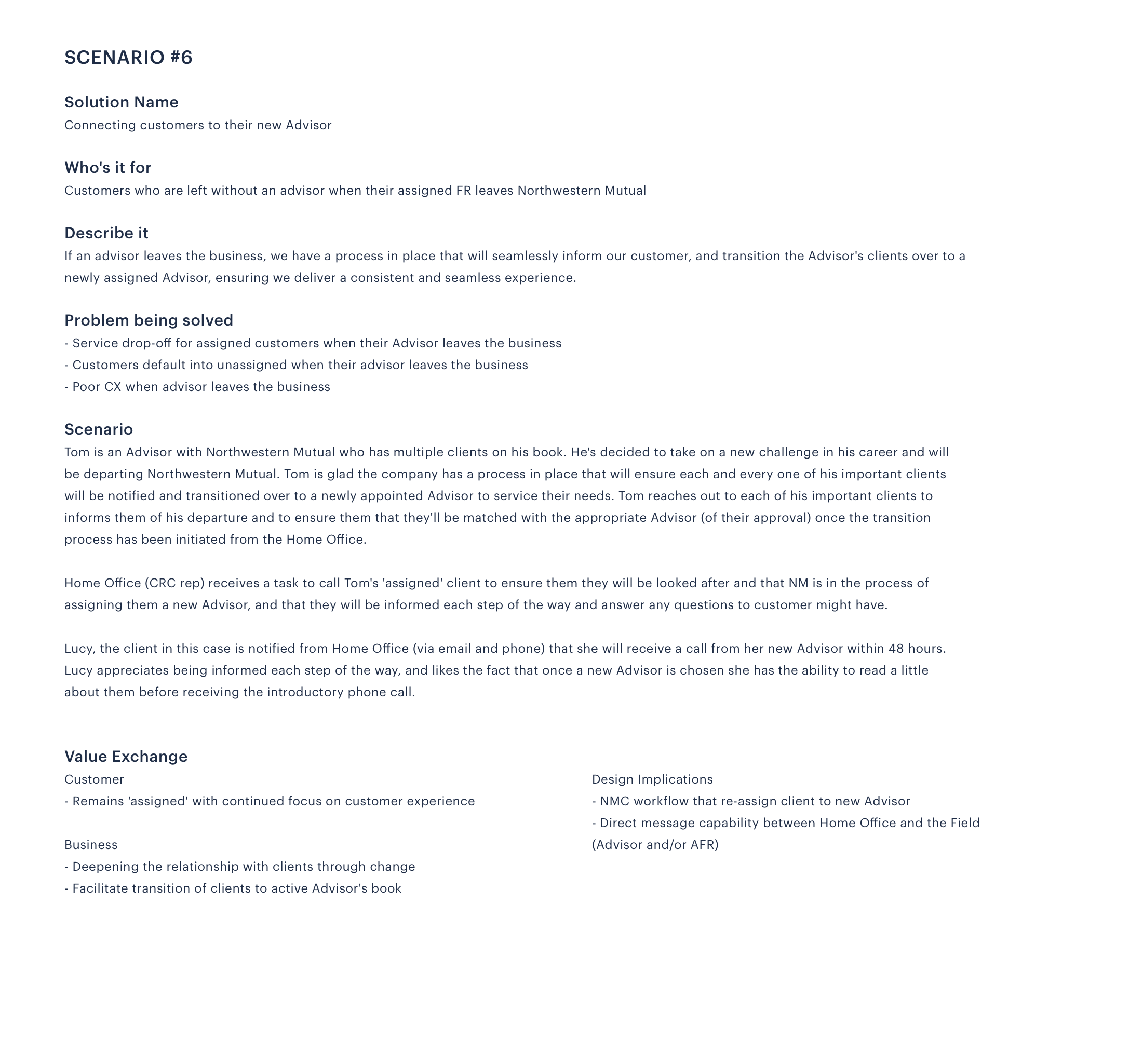

The new servicing experience had to be realized in different ways for specialized groups. Here, scenarios and blueprints helped articulate future-state experiences, both frontstage and backstage. Articulating the front and back stage experiences helped teams align on roadmaps, and it helped everyone involved see the bigger picture.

These blueprints were some of many, connecting dozens of product teams, few of whom were communicating. These jumpstarted a digital strategy to align insurance products and their digital transition.

IN THE CLAIMS SPACE ALONE, OUR WORK TO RECONFIGURE THE TEAMS, INTRODUCE NEW DIGITAL TOOLS, AND STREAMLINE THE PROCESS IS EXPECTED TO LEAD TO AN AVERAGE OF $7,000 IN ANNUALIZED PREMIUM PER REP PER WEEK, 300 NEW LEADS TO THE FIELD PER WEEK, AND A PREDICTED $1B PER YEAR BEING REINVESTED WITH THE COMPANY.

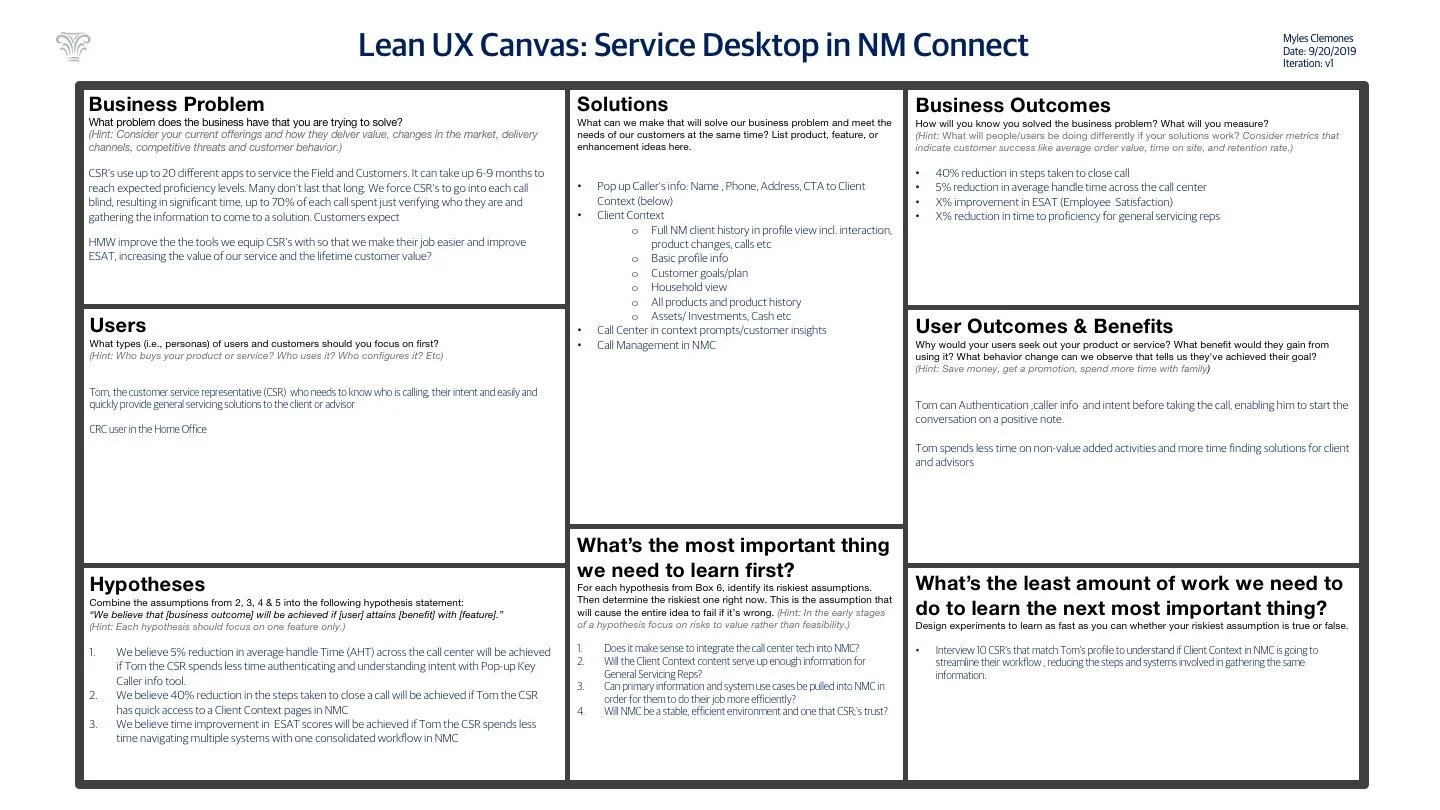

To orient stakeholders and improve transparency, I used a simple mapping tool to align the working team. A Lean UX canvas helped frame the problem space, primary users, intended solutions, business outcomes, supporting hypotheses, and more. Particularly important was having a visible, concise artifact that required input from multiple teams.

APPROX. 70% TIME SPENT ON CALLS IS RELATED TO POOR SERVICING TOOLS. AGENTS USE 20-25 SYSTEMS. WORSE, THEY GO INTO EACH CALL BLIND, NO CONTEXT, NO IDEA WHO IS CALLING, AND NO SIMPLE WAY TO GET A 360 VIEW OF THE CLIENT.

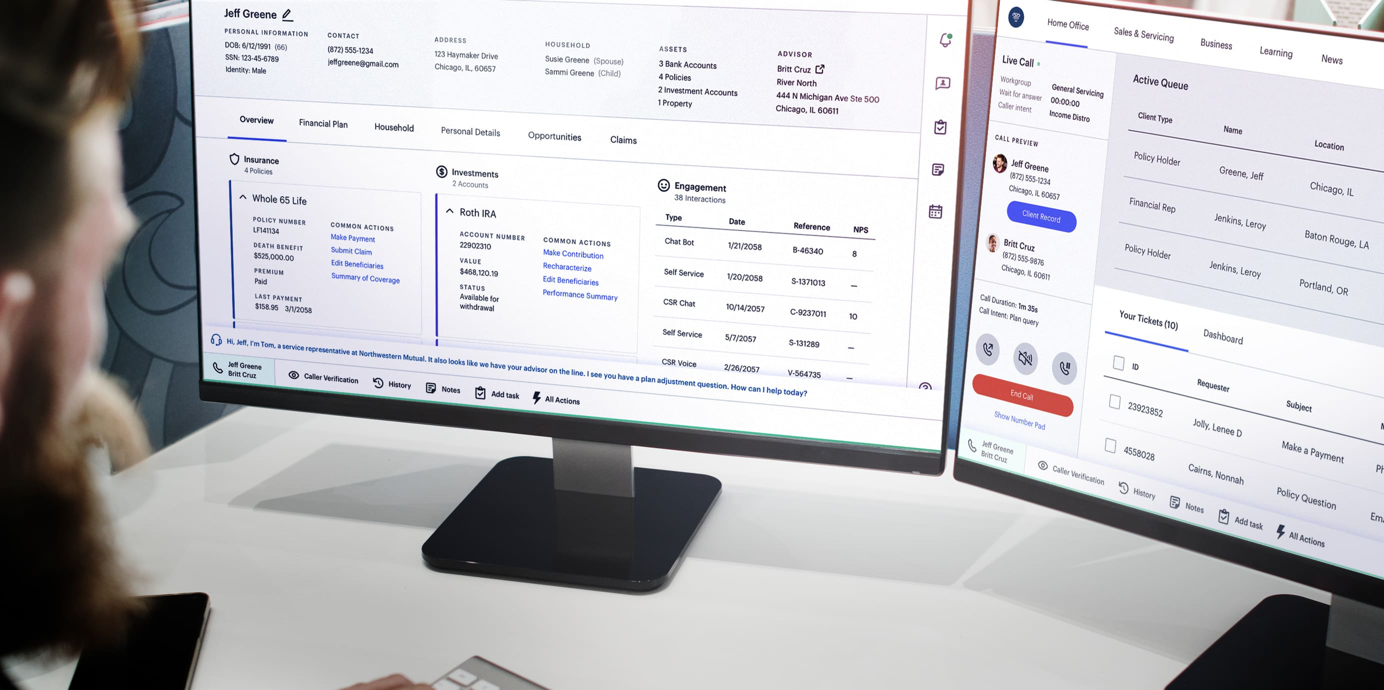

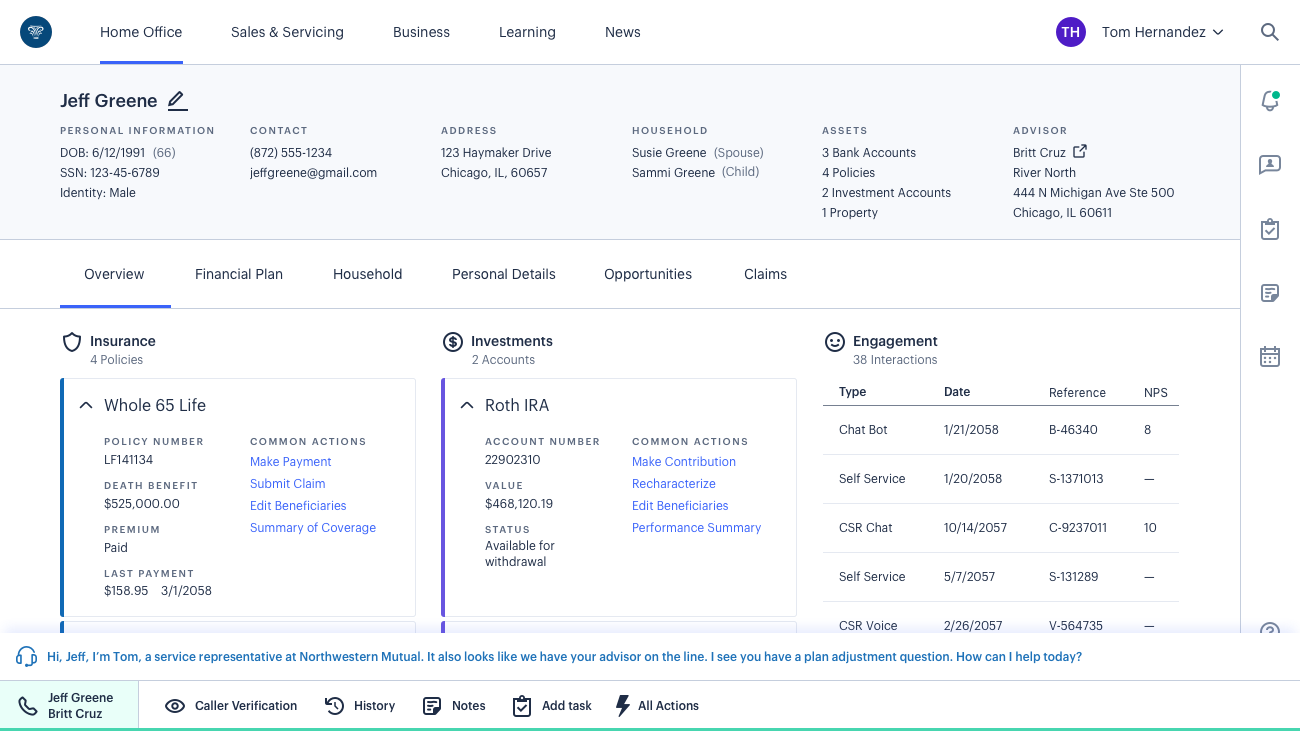

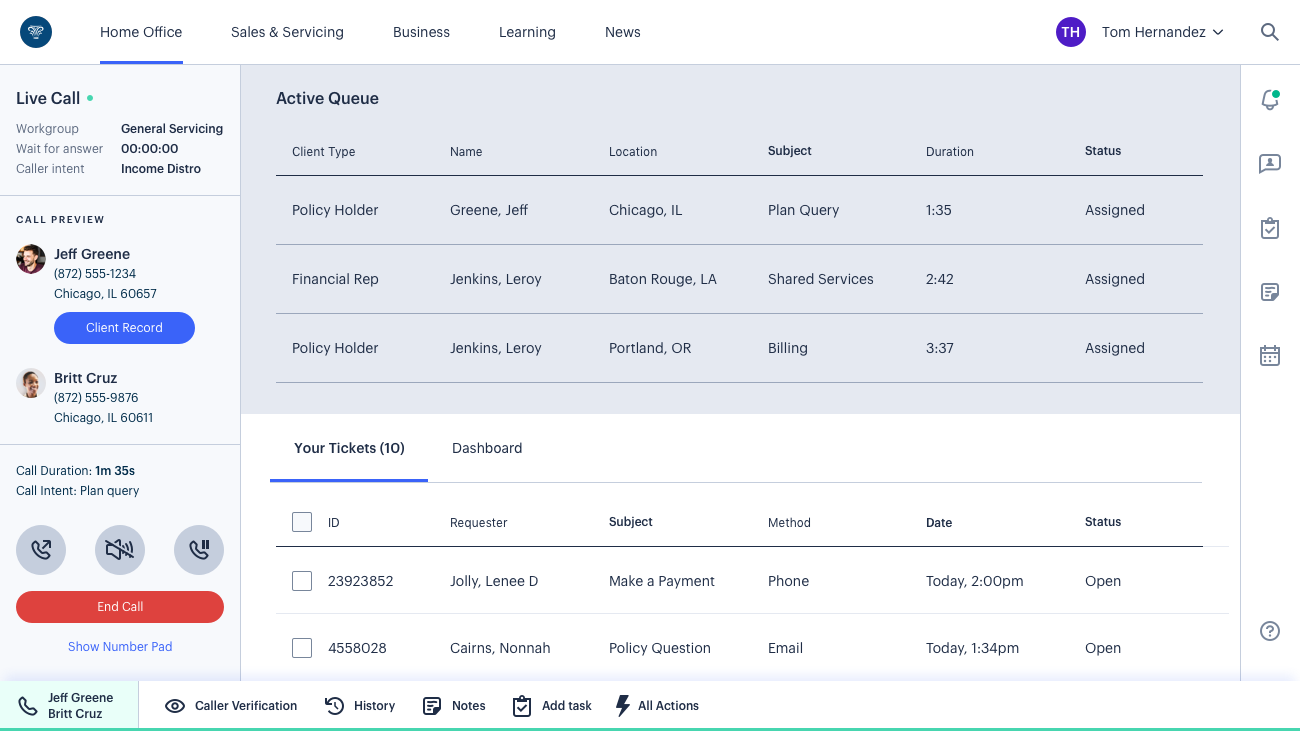

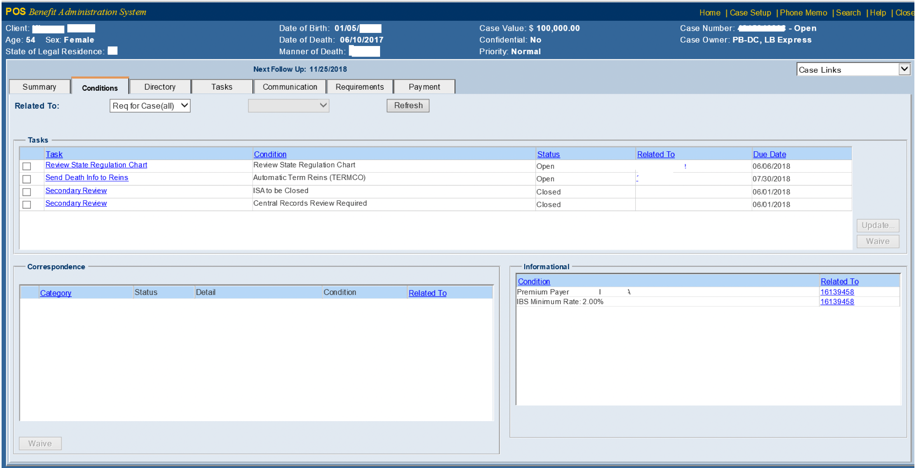

Efforts were underway to consolidate and sunset some legacy apps into the platform. Here, I conceptualized the working environment. To prioritize information and features. I used critical pain points and high-volume tasks, and other secondary research data to illustrate the platform's future experience.

The servicing agent has a complete view of the client profile in NM Connect, allowing him to personalize the conversation and promptly complete tasks. Agents can see the client’s owned products, financial plan, interaction history, case notes, etc.; everything needed to service clients. , Above, computer telephony integration surfaces key client facts and product information enabling efficient workflow, task management, interaction history, etc.

METRICS

LONG TERM

Reduced CSR attrition rate of CSR’s

Improve ESAT (Employee satisfaction score)

Reduced % orphan client

Increased Sales

Improved CSR time to proficiency

SHORT TERM

Reduced % Abandoned Call Rate (ACR)

Reduce no. Average Call Transfer Rate

Increase % First Contact Resolution (FCR)

Increased % ticket/call closures per day/month

Reduced Average Handle Times (AHT) for transactional calls

50% reduction in steps taken to reach a solution