THE CHALLENGE

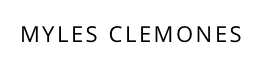

Redesign the digital experience for borrowers on PHEAA’s federal and commercial loan servicing loan platforms. The Pennsylvania Higher Education Assistance Agency is one of 9 major student loan servicers that collect and manage student loan payments on behalf of the federal government and commercial lenders. Pheaa services both the federal (Myfedloans) and commercial (American Education Services) lenders through respective platforms.

The project was a part of a larger digital transformation effort lead by Wipro, Designit’s Strategy and Engineering arm. Designit was responsible for the service design scope of work for Pheaa’s mobile app and desktop portal.

To comply with my non-disclosure agreement, I have omitted confidential information in this case study. The information in this case study is my own and does not necessarily reflect the views of the client.

MY ROLE

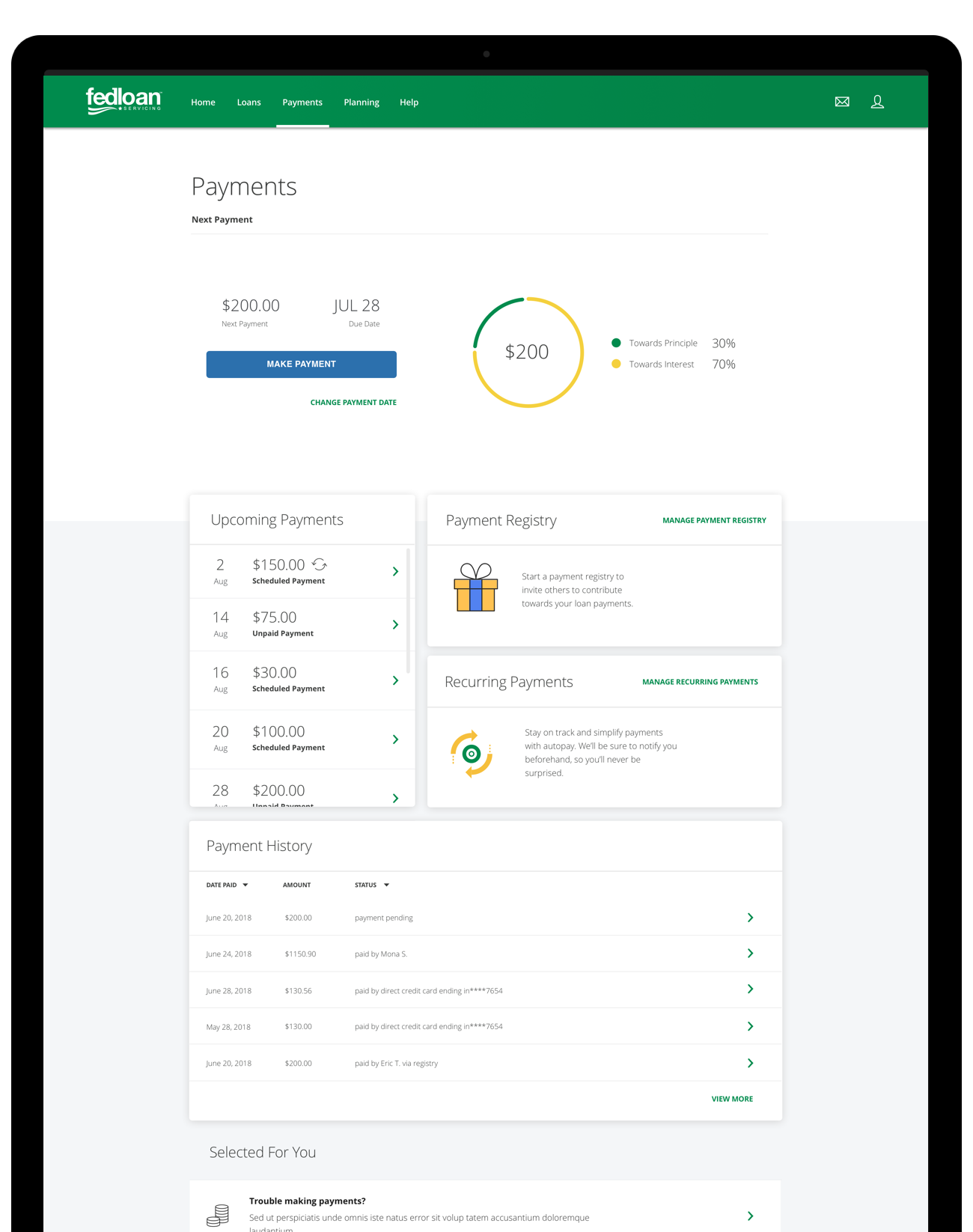

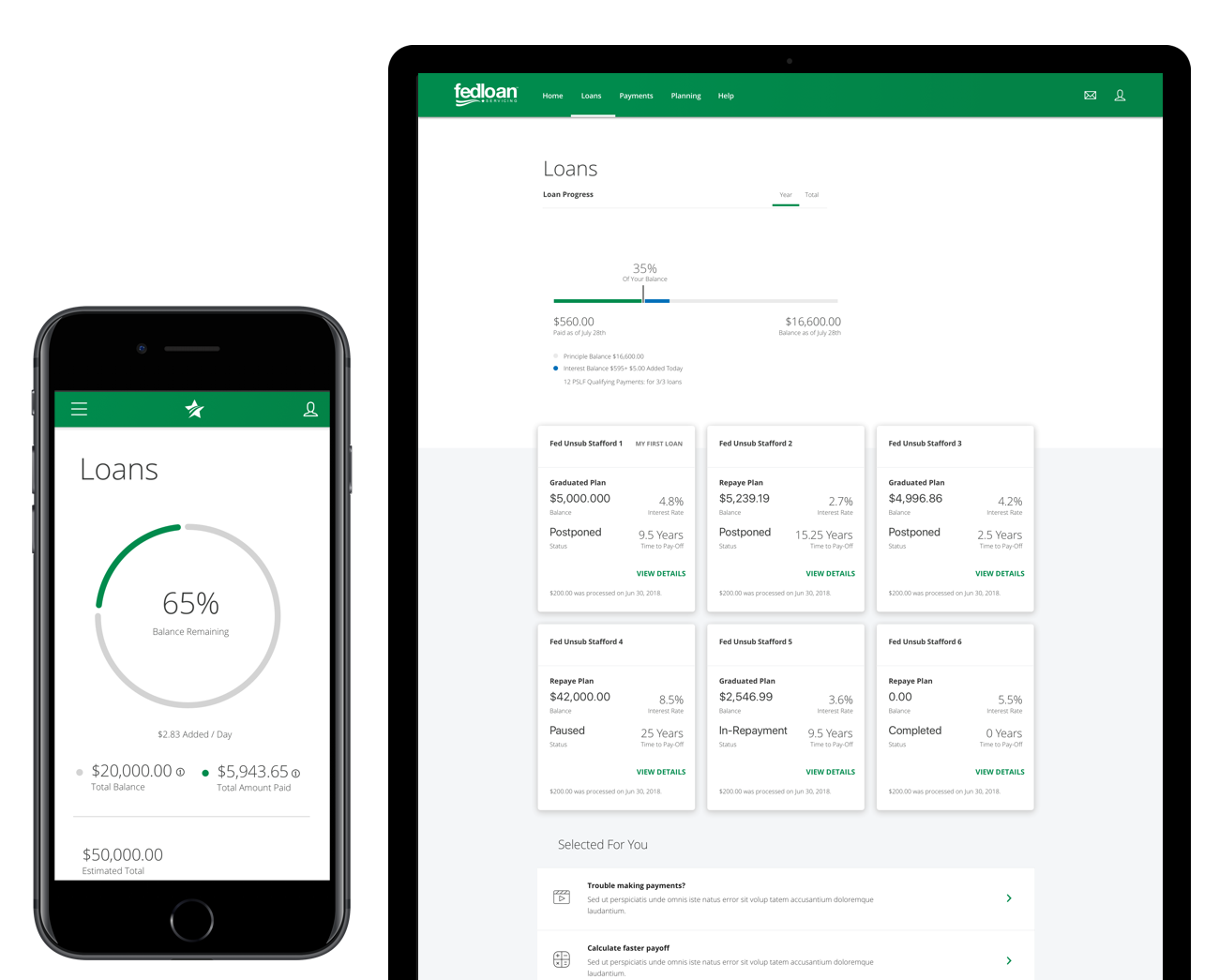

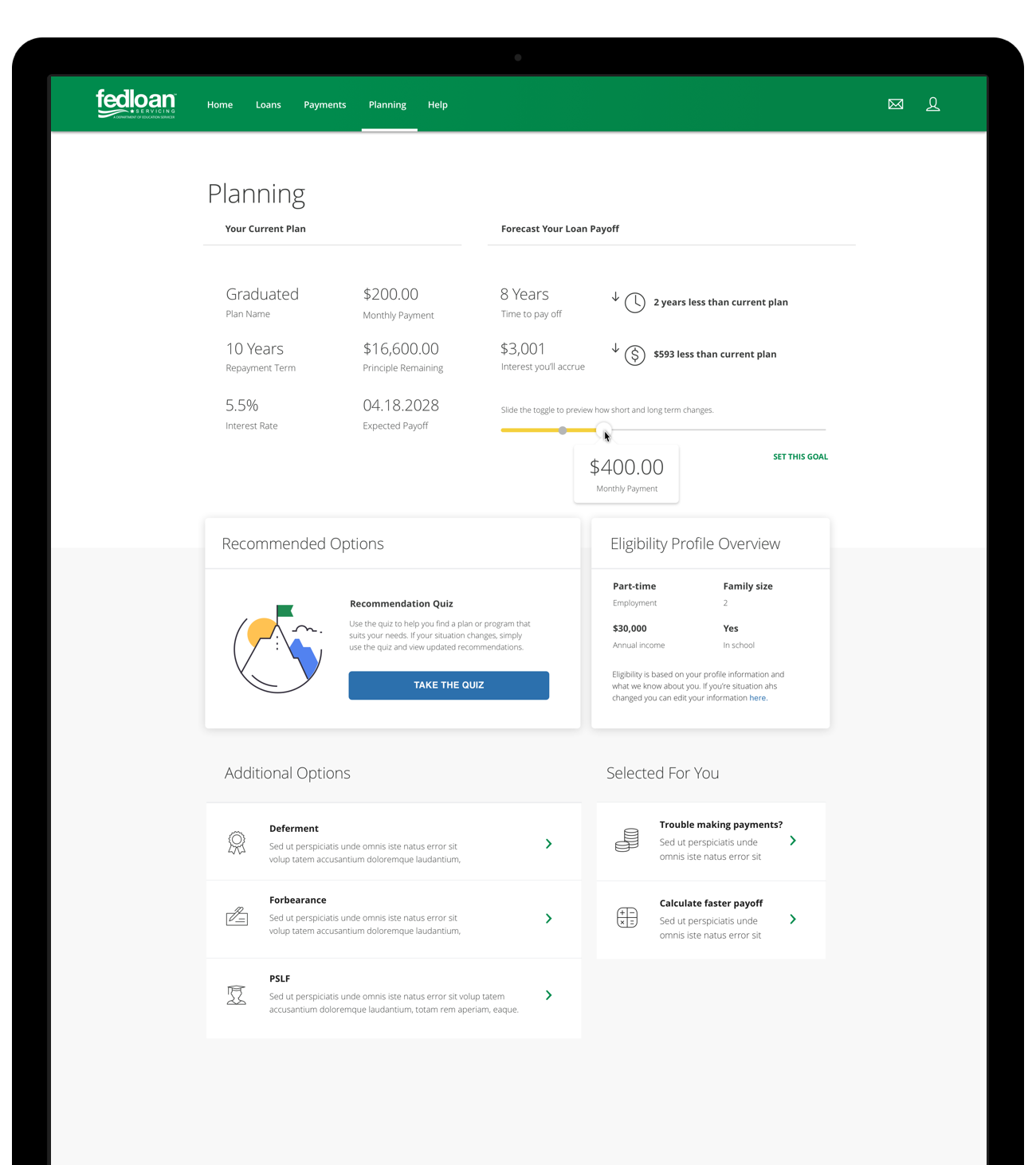

My responsibilities at Designit were to lead one of two tracks to reimagine the portal experience along with both team tracks sharing a consistent look and feel. Regarding design outputs, my focus was the desktop portal experience. The portal, being the interface between the business and its users is used by customers to learn about student loans, make payments, manage, track, explore alternatives, and much more.

THE APPROACH

Over several months, we sought to understand the needs of former, current, and future student loan holders, to hear their stories, and identify opportunities to not only build an experience that meets their needs but consider how we can help combat systemic student loan debt faced by millions of loans holders across the US.

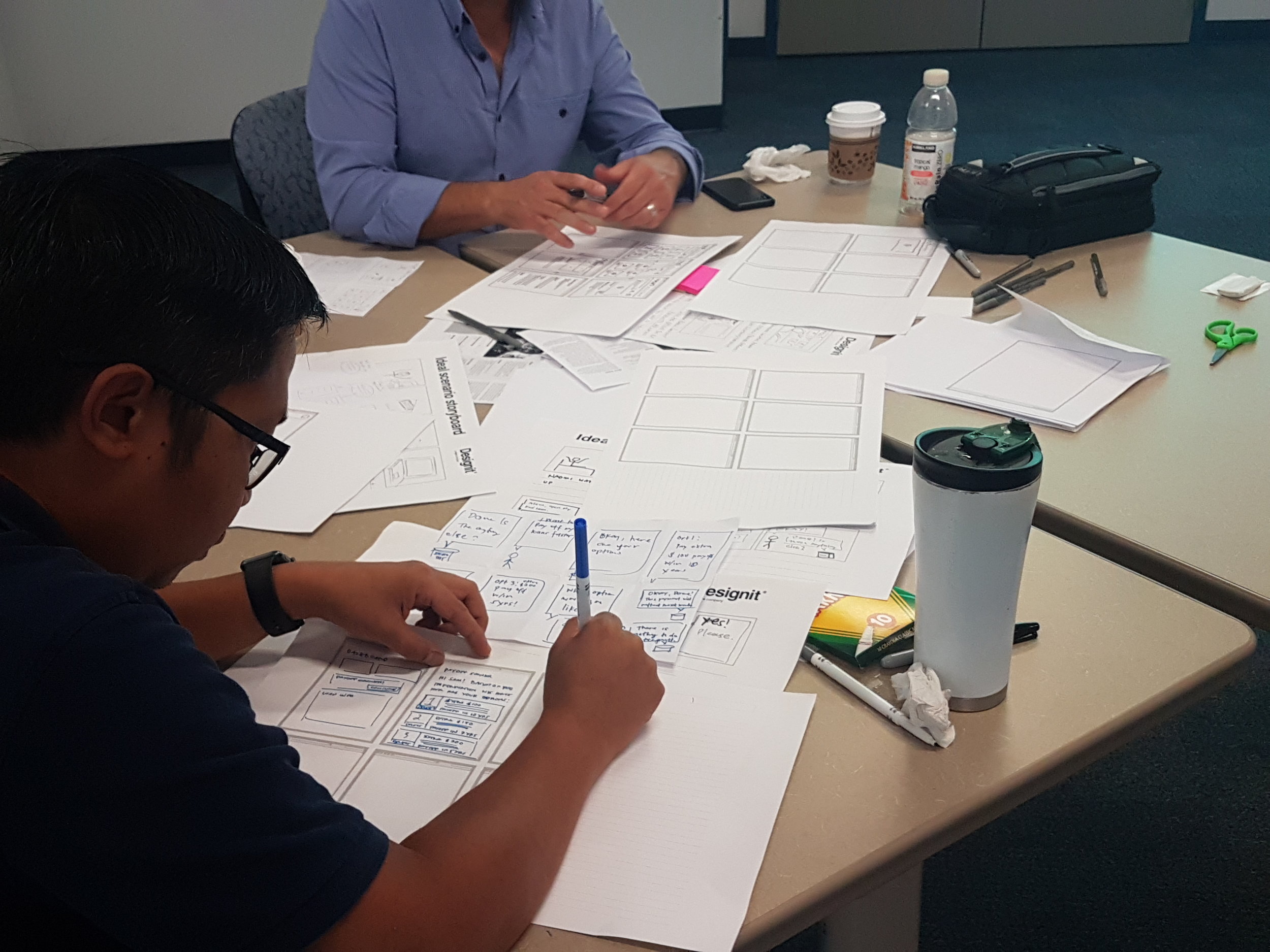

The project also required on-site training of service design methodologies. I was part of the team of two responsible for designing the material and facilitating the training.

Photo credit: Katie McCurdy

DISCOVERY: STAKEHOLDER WORKSHOPS

We began by getting all project team members together to ensure we had alignment and understanding on project objectives and milestones. More importantly, this was a chance to hear about things the client knew, what they weren't sure about and any challenges or concerns moving forward.

Two activities I've found extremely useful in getting teams aligned and helping me to understand the current business landscape is to do a Lean Canvas and Landscape Review.

LEAN CANVAS

I try to use a jumbo version of the canvas; there's something appealing about creating a physical artifact that you can see and touch – it also gets participants actively involved and throwing post-its up on the canvas.

The canvas, an adaptation of the business model canvas is a great way to understand product/market fit and visualize the business model for the current or future value proposition offering. It focuses more on the problem and customer segments than key partners (business model).

The great thing about using the canvas is it fits on one poster, making it quick, to the point, and portable.

LANDSCAPE REVIEW

The landscape review is another quick technique I use to help understand the business landscape and assumptions the project team have. Again, it’s a bias towards action over documentation, enabling the team to quickly get a view into what the team does and doesn’t know.

The format is pretty simple;

Draw up a 2 x 2 quadrant

Write one of the following labels in each box - ‘What do we know?’, ‘What do we think we know?’, ‘What do we want to know?’ and ‘Who is the audience?’

I then had the team populate each area, eventually extracting known business or consumer-facing problems and insights into who their target audience is.

IMMERSION INTO THE STUDENT LOAN LANDSCAPE

A series of in-home and phone video conference interviews were conducted across key segments in order to understand the current landscape of Pheaa customers (and non-customers), focusing on their needs, behaviors, and challenges when it came to dealing with student loans and finance in general.

The research enabled us to test some of the assumptions from project kick-off but also identify opportunities for the business and how they might set themselves apart from the competition.

BUSINESS DESIGN THINKING

I prepared and conducted a series of stakeholder interviews with C-level execs, department managers, product owners, and project managers to understand initiatives underway within the business and how our work could feed into and support those efforts. The success of the project required their support so whilst these conversations were an open, informal forum to understand the inner workings of the business it was an opportunity to understand their challenges and goals at an individual and team level.

MAPPING THE CUSTOMER JOURNEY

The accumulation of the research and synthesis helped us formulate an understanding of customer behaviors when establishing and maintaining a relationship with Pheaa for the loan duration. We discovered that there were key moments of opportunity spanning from the moment the servicer is identified and you enter grace period through to helping those struggling with payments looking to get back on track.

IDEATION AND PROTOTYPING

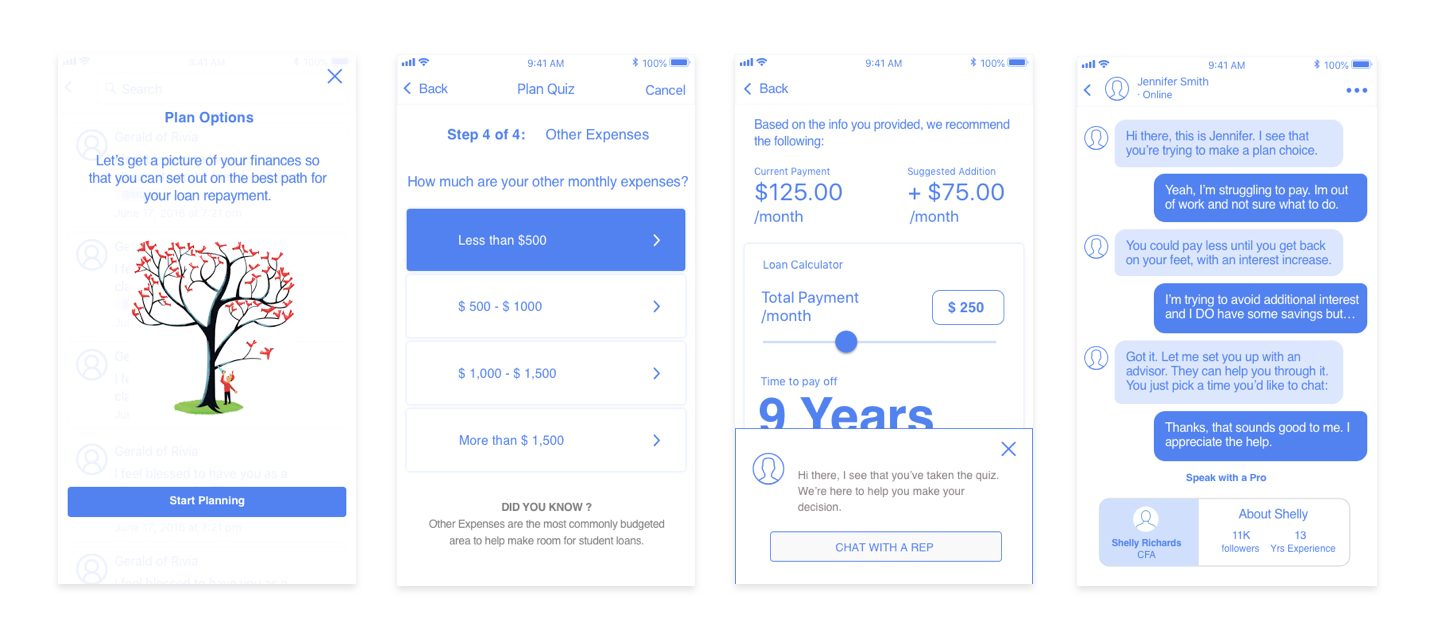

Following research and synthesis, we had some assumptions on how the current experience could improve along with new ideas and features that could help borrowers at key moments.

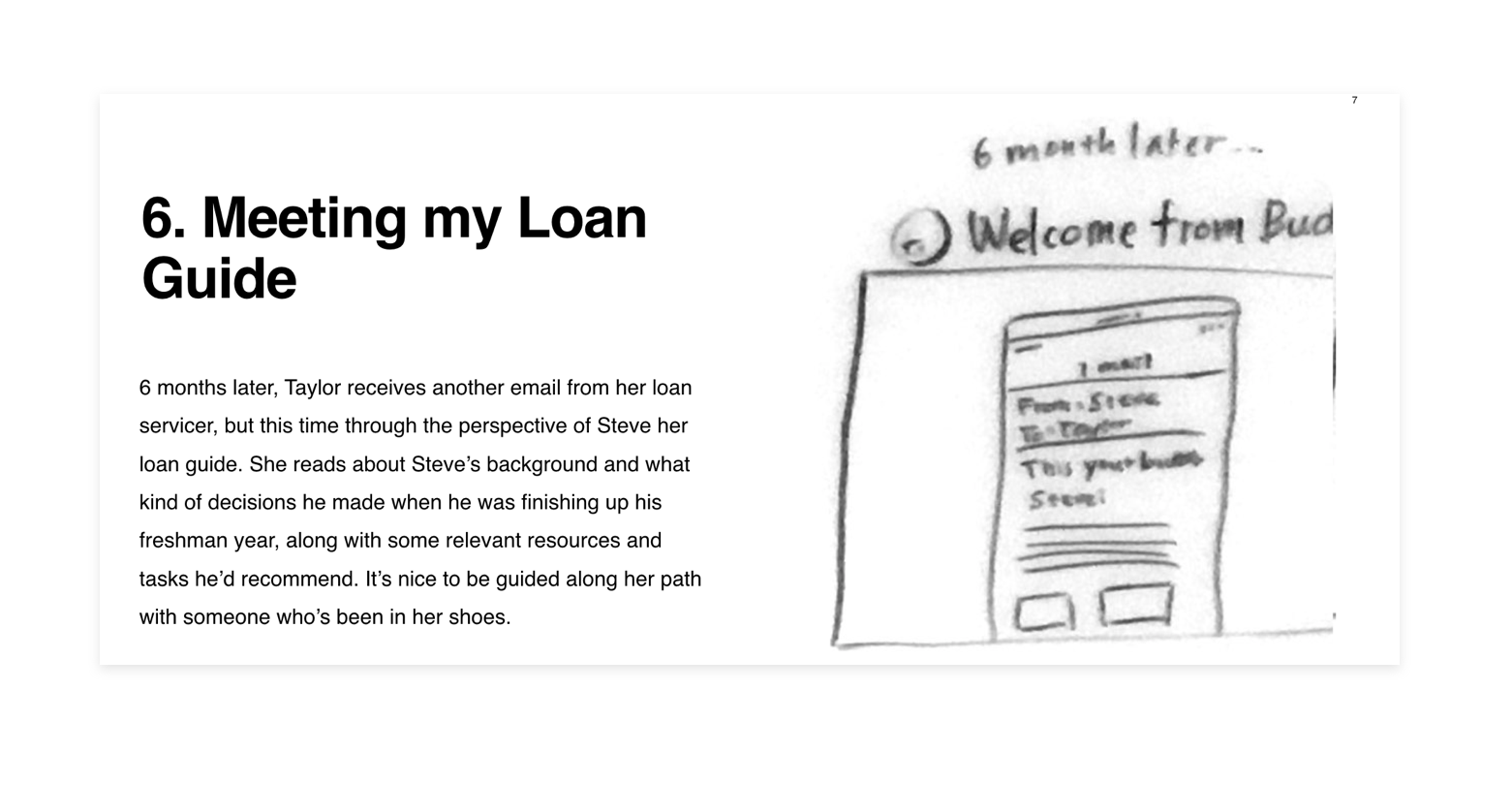

These ideas were written up as future state scenarios, and sketches were developed to picture what the future experience could look like and how it unfolds over time.

We then increased the fidelity of the ideas and created wireframes in Sketch App that would be used for concept validation testing.

Above: Future state scenario and sketch

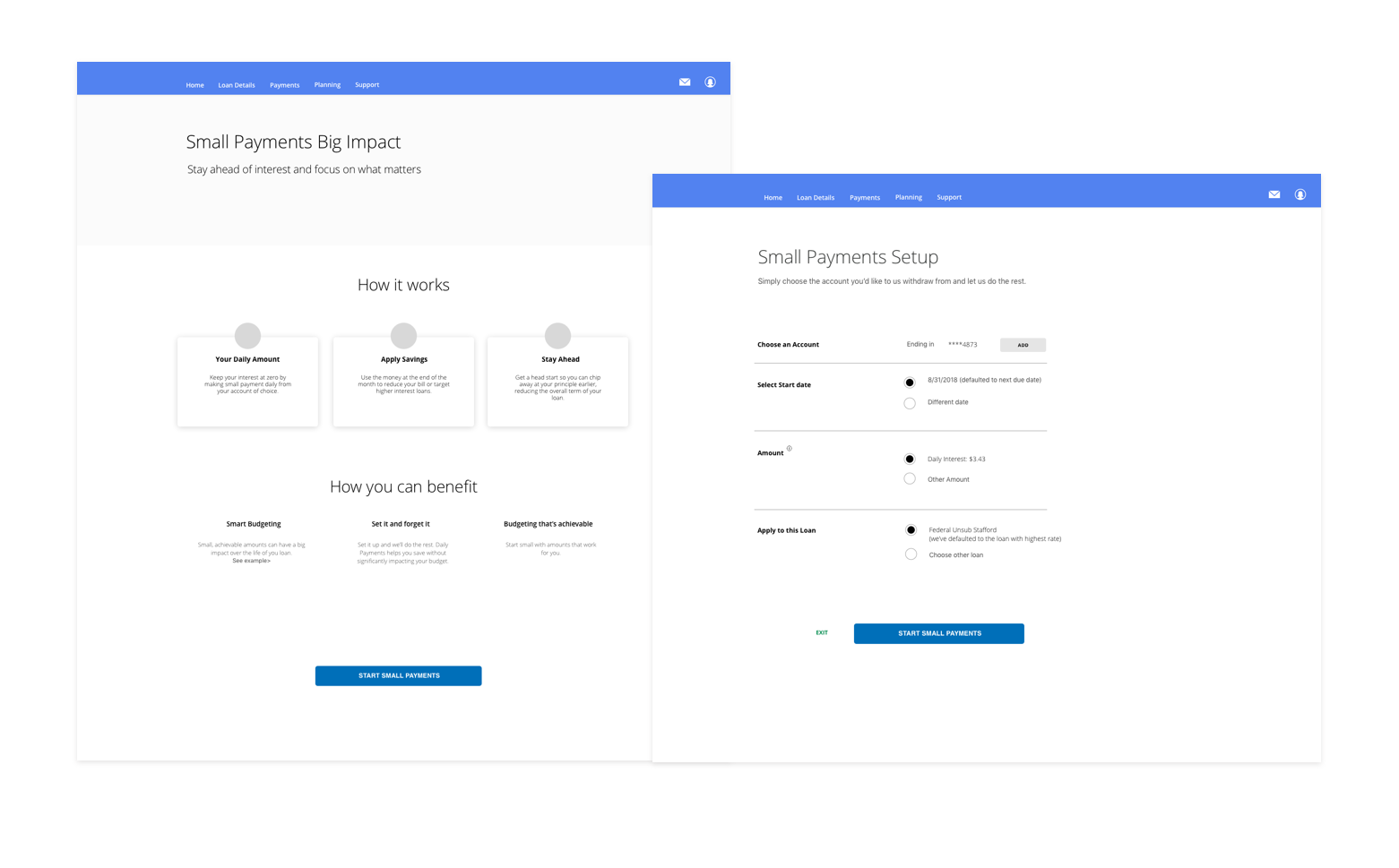

Above: An example of one of the scenarios we wanted to test. The sketches were transformed into low fidelity wireframes for concept testing.

Above: Example of a wireframe concept that enables borrowers to set up automatic small payment amounts from an account of their choice.

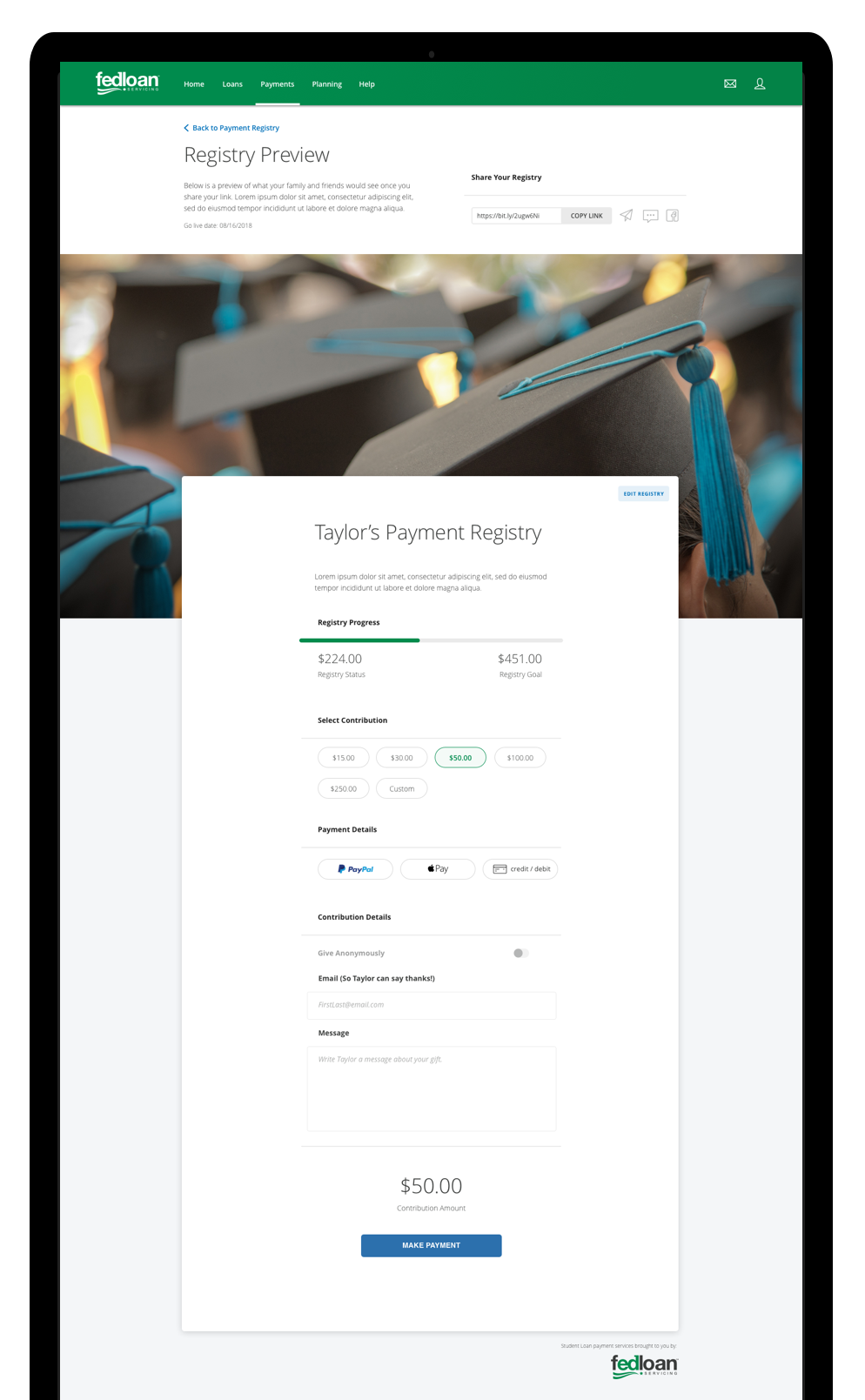

Above: Final design of a ‘Payment Registry’ page, enabling borrowers to receive small cash injections whilst they’re in grace period.

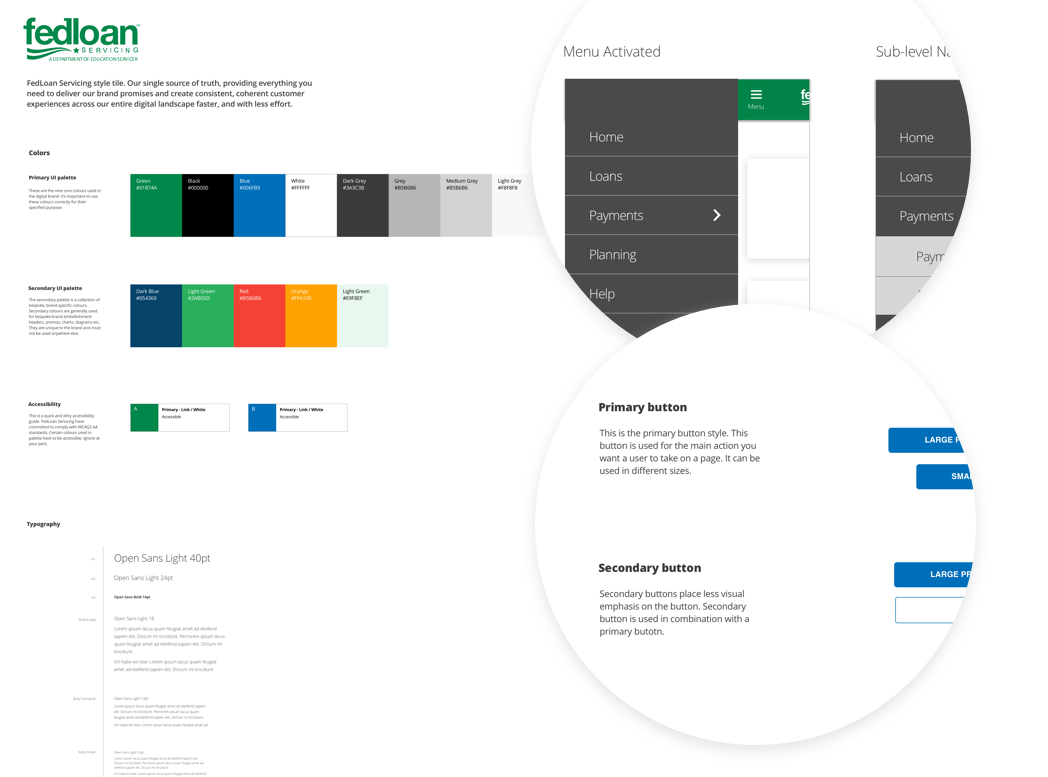

COMPONENT LIBRARY

Throughout the course of the design work, we’d accumulated quite a few new components. In order to consolidate these, I created a component library to ensure the client will have coherent customer experiences across their entire digital landscape and hopefully enable faster delivery with less effort.

The library was to provide guidance and speed up design processes and inconsistencies in the absence of a living, breathing design system (DSM). I included use cases and descriptions to help frame each of the elements in the library.

Above: Component library consolidating assets used across the project

SERVICE DESIGN TRAINING

I was part of a team of two who created and facilitated the hands-on Service Design and Problem-Solving workshops that covered four core disciplines;

Service Design

Design Research

Ideation

Prototyping

Above: Mapping a future state service model

Above: 8up sketching

MY ROLE

Service Design, Product Design, Research, Design Strategy, Business Design, Innovation Training

THE TEAM

Raghavendra Kanvala (Design Lead), Jen Zhao (Senior UX/Research), Sarah Knotz (En Designer, William Conklin (CD)

To comply with my non-disclosure agreement, I have omitted confidential information in this case study. The information in this case study is my own and does not necessarily reflect the views of the client.